Unitech Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030) | Unitech Fundamentals, Financial Trends, Businesses, Future Plans and more

In this article we are going to talk about Unitech Limited, a company related to real estate sector. Although it is a penny stock with very less chances of future growth.

But still many people were commenting to do Unitech Limited detail analysis. If you also want to invest in this stock, then read this article completely so that you can understand this stock of Unitech very well.

Hey friends I am Sachin a finance enthusiast and author of this blog, and I have brought you the best analysis of Unitech Ltd. First of all we will analyze it well after that we will try to Predict Unitech Share Price Target. So stay tuned till the end of the blog, so let’s get started.

Do you want to know the projected value of Unitech Share Price Target 2025 ? You have come to the right place.

Purchasing Unitech Ltd. shares might be hazardous because it is a small-cap stock. Over the past five years, the share has underperformed; its return of only +37% is deemed poor.

Thus, this piece might serve as a guide for your investment if you choose to buy Unitech shares. As for investors’ predictions, some say that this share won’t provide profitable returns over time. So let’s examine the Unitech Share Price Target and attempt to project its future.

Table of Contents

ToggleUnitech Share Overview

An Indian real estate firm called Unitech Limited works in a variety of construction-related markets. Having been formed in 1972, the firm is well-known in both residential and commercial real estate. Housing, retail, hotel, and infrastructure development are among the projects that Unitech works on.

The organization works hard to accomplish a variety of real estate projects, such as building hotels, malls, IT parks, residential and commercial complexes, and infrastructure projects. Large-scale initiatives that Unitech has completed in a number of Indian cities have helped the country’s urban growth.

Metrics Explained –

- Market Cap (Market Capitalization): ₹3,417 Crores: Market capitalization signifies the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 typically suggests that either the company has negative earnings or the earnings are unavailable.

- Industry P/E (Price-to-Earnings Ratio): 49.78: The industry’s average P/E ratio is 50.94. Comparing the company’s P/E of 0 with the industry average suggests that the company might not be generating positive earnings or might significantly underperform the industry average in terms of profitability.

- ROE (Return on Equity): 110.21%: ROE measures a company’s profitability concerning shareholders’ equity. An ROE of 110.21% indicates that the company generated a profit of 110.21% concerning each rupee of shareholders’ equity.

- EPS (Earnings Per Share): -9.20: In this instance, the negative EPS of -9.20 means the company experienced a loss per share over a specific period.

- Book Value: -7.96: . It is a negative value, indicating a potential issue with liabilities exceeding assets.

- Dividend Yield: 0%: A dividend yield of 0% indicates that the company did not pay any dividends during the period.

- Debt to Equity Ratio: -3.46: The debt-to-equity ratio represents a company’s financial leverage. A ratio of -3.46, while unusual, could imply that there’s more equity than debt.

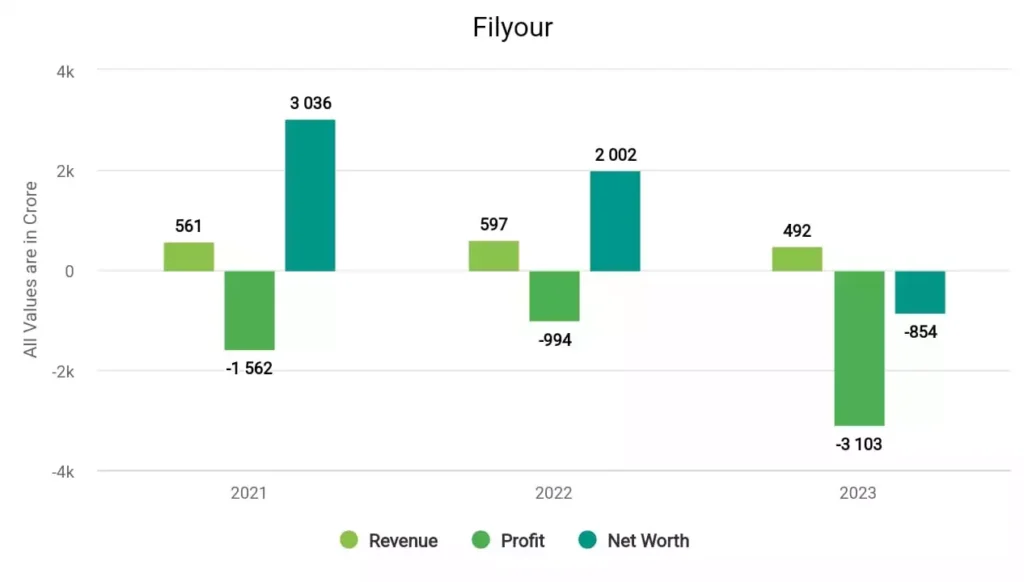

Unitech Financials Trend

The company’s revenue increased to ₹561 crore in 2021, but it suffered a loss of ₹-1,562 crore. The next year, it reduced its loss to ₹-994 crore and raised its revenue to ₹597 crore. However, in 2023, the company’s loss worsened to ₹-3,103 crore and its revenue dropped to ₹492 crore.

Unitech Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Unitech Share Price Target 2024 | ₹3.36 | ₹3.42 |

| Unitech Share Price Target 2025 | ₹3.63 | ₹3.76 |

| Unitech Share Price Target 2026 | ₹3.92 | ₹4.14 |

| Unitech Share Price Target 2027 | ₹4.23 | ₹4.55 |

| Unitech Share Price Target 2028 | ₹4.57 | ₹5.01 |

| Unitech Share Price Target 2029 | ₹4.94 | ₹5.51 |

| Unitech Share Price Target 2030 | ₹5.33 | ₹6.06 |

| Unitech Share Price Target 2035 | ₹9.80 | ₹11.00 |

Also Read –

Unitech Share more details are available in this video –

Unitech Share Price Target 2024

The share has outperformed the market in the past year. Unitech share has delivered returns of +87% and +145% in the previous six months, which is remarkable. The experts anticipate high returns from this share, which is why Unitech Share Price Target 2024 could be INR 3.36 and the highest price could be INR 3.42. Investing in this share is quite risky, so conduct thorough research before investing in this share for the short term.

Unitech Share Price Target 2025

In case you are wondering, Unitech share might offer huge returns in the future, but you should be careful before putting your money in it. The company has poor financials and fundamentals, which makes it a bad investment choice. Based on its historical performance, the lowest and highest Unitech Share Price Target 2025 could be INR 3.63 and INR 3.76 respectively.

You might ask why this stock is rising steadily. We don’t have a clear answer to that, but some sources say that the share is being manipulated, which is causing an increase in the share price. Therefore, this share is very risky and you could lose your money easily.

Unitech Share Price Target 2030

According to our analysis, Unitech Share is not a good investment option for either short-term or long-term investors. The share price target for 2030 is INR 9.80, but if it reaches this level, it may drop further to INR 3.76.

Future of Unitech Share

Unitech Ltd has poor financial and fundamental performance, indicating a bleak future. Some self-proclaimed advisors claim that this stock will quickly double your money. However, this is a very risky investment and if the stock price drops sharply, you may not be able to sell your shares and your money will be locked in.

Conclusion

We hope you enjoyed this blog and we would love to hear your feedback in the comments section. In this article, we have explored the Unitech share price target for 2023, 2024, 2025, and 2030 as comprehensively as possible.

If you have any other questions or queries about this topic, please feel free to comment and we will do our best to provide you with satisfactory answers. Also, if you found this article useful, please share it widely with your friends and contacts.

The Unitech Share Price Target 2024, 2025, 2026, 2030 that has been told on the basis of technical analysis and its technical time keeps on changing from time to time. That’s why this price target is not accurate, if you invest in it, do it on the basis of your research and never invest due to greed.

FAQs

Is Unitech a debt free company?

No, the Unitech has a huge debt of ₹4020 crore and its debt to equity ratio is 1.32.

When was the Unitech company established?

The Unitech company was established in 1986.

What is the Debt of Unitech company?

Unitech company has a debt of ₹ 7,167 crore and a debt-to-equity ratio of 3.49.

What is the share price of Unitech in 2025?

In 2025, Unitech’s share price could reach ₹3.76 at its peak, or ₹3.63 on average.

Also Read –