IRFC Share Price Target (2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030) | IRFC Financial Trends, Fundamentals, Businesses and more

Indian Railway Finance Corporation (IRFC) is a public sector organization that is fully owned by the Indian government and is governed by the Ministry of Railways on an administrative level. The Indian Railways, one of the largest and most important infrastructure sectors in the nation, has a specific finance division called IRFC. To finance the purchase of rolling stock assets, the leasing of railway infrastructure assets, and the financing to organizations under the Ministry of Railways, IRFC raises money from local and international financial markets. Through several programs and tools, IRFC also finances railway construction projects and capacity improvement initiatives.

Since its incorporation in December 1986, IRFC has contributed significantly to the development and modernization of the Indian Railways. More than 75% of the Indian Railways’ whole rolling stock fleet, which consists of locomotives, coaches, wagons, and other vehicles, has been financed by IRFC. As of March 31, 2022, IRFC had additionally funded project assets totaling more than Rs 2.22 lakh crore. As of March 31, 2022, IRFC has invested a total of Rs 5.04 lakh crore in the rail industry.

IRFC is a profitable and dividend-paying company with a consistent track record of growth and performance. IRFC has maintained a zero non-performing asset (NPA) ratio since its inception and has a high credit rating from domestic and international agencies. IRFC has a diversified borrowing mix and a low cost of funds, which enables it to offer competitive rates and terms to its customers. IRFC has also been exploring new avenues of funding such as green bonds, masala bonds, infrastructure investment trusts (InvITs), and asset monetization.

Table of Contents

ToggleOverview of IRFC

| Industry | Financial services |

|---|---|

| Founded | 12 December 1986 |

| Headquarters | New Delhi, India |

| Key people | Amitabh Banerjee (Chairman & MD) |

| Products | financial |

| Services | Leasing Lending Borrowing |

| Website | irfc.co.in |

| Profile | IRFC |

IRFC made its debut on the stock exchanges in January 2021 through an initial public offering (IPO) of equity shares for Rs 26 per share. The IPO was oversubscribed by 3.49 times and received a positive response from investors across categories. The IPO proceeds were used to augment IRFC’s equity capital base and meet its future capital requirements.

Since its listing, IRFC’s share price has witnessed a strong rally and has delivered multi-bagger returns to its shareholders. IRFC’s share price has surged by over 125% in the past three months and hit a fresh 52-week high of Rs 77.10 on September 8, 2023. IRFC Share Price Target has outperformed the benchmark indices and its peer group companies in the same period.

Given these factors, IRFC’s share price is expected to continue its upward momentum and reach new highs in the coming years. Based on the consensus estimates of various analysts and brokerage firms, IRFC’s share price target for 2023, 2024, and 2025 are as follows:

| Year | Share Price Target | Upside Potential |

|---|---|---|

| 2023 | Rs 85 | 10% |

| 2024 | Rs 100 | 30% |

| 2025 | Rs 120 | 55% |

IRFC (Indian Railway Finance Corporation) is a public sector enterprise that provides financial services to the Indian Railways and its subsidiaries. It raises funds from domestic and international markets to finance the acquisition, leasing, and lending of railway assets and infrastructure projects. IRFC was listed on the stock exchanges in January 2021 and has been attracting investors’ attention ever since.

In this article, we will analyze the performance, prospects, and valuation of IRFC and provide our share price target for the next five years. We will also use a chart table to visualize the historical and projected data of IRFC. Finally, we will answer some frequently asked questions about IRFC and its share price.

Also Read – Marine Electricals Share Price Target

IRFC Performance Review

IRFC has been consistently growing its revenue, profit, and assets over the years. It has a diversified borrowing mix and high credit ratings, which enable it to access funds at competitive rates. It also enjoys a monopoly position as the sole financier of the Indian Railways, which ensures a steady demand for its services.

The table below shows the key financial indicators of IRFC for the last five fiscal years (FY17-FY21).

| Indicator | FY17 | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|---|

| Revenue (in Rs crore) | 8,599 | 9,207 | 10,987 | 13,421 | 15,770 |

| Profit after tax (in Rs crore) | 2,001 | 2,203 | 2,140 | 3,192 | 4,416 |

| Assets under management (in Rs crore) | 1,34,150 | 1,54,632 | 1,86,494 | 2,66,544 | 3,29,356 |

| Return on equity (%) | 11.6 | 11.4 | 9.8 | 12.5 | 14.7 |

| Earnings per share (in Rs) | 2.0 | 2.2 | 2.1 | 3.2 | 4.4 |

As we can see from the table, IRFC has been increasing its revenue and profit at a compound annual growth rate (CAGR) of 16.3% and 21.9%, respectively. Its assets under management have also grown at a CAGR of 25%. Its return on equity has improved from 11.6% in FY17 to 14.7% in FY21, indicating its efficiency in generating profits from shareholders’ funds. Its earnings per share have more than doubled from Rs 2 in FY17 to Rs 4.4 in FY21.

The chart below shows the trend of IRFC’s revenue, profit, and assets over the last five years.

!IRFC Revenue Profit Assets Chart, profit (green), and assets (red) over the last five years”))

The chart clearly illustrates the strong growth trajectory of IRFC across all parameters.

IRFC Share Price Target for 2025

IRFC Share Price Forecast for 2025 IRFC share is currently trading at around Rs 45 per share. However, many stock market experts believe that IRFC has the potential to grow moderately in the next few years.

I. IRFC Share Price Target for 2023

According to Choice Broking, IRFC is on a positive trend and can breach the Rs 50 mark by the end of this month. They have given a buy rating to the stock with a target price of Rs 54.

II. IRFC Share Price Target for 2024

If IRFC launches new projects, which are expected to happen in 2023 (we will discuss them in the next section), then its share price may rise further and reach between Rs 60-70 in 2024. This is based on the assumption that IRFC will continue to increase its revenue and profitability from its core business of financing railway assets.

III. IRFC Share Price Target for 2025

By 2025, IRFC’s share price could touch Rs 80-90, as the corporation has several projects in its pipeline and its earnings are likely to grow in the future, according to some industry analysts. IRFC is also expected to benefit from the government’s support and policy initiatives for the railway sector, which is undergoing significant transformation and modernization.

IRFC Share Price Target 2023, 2024, 2025, 2026, 2030 Table

According to the web search results, the IRFC share price target for 2023, 2024, 2025, 2026, and 2030 based on various sources are shown in the table below:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| IRFC Share Price Target 2023 | 38 | 42 |

| IRFC Share Price Target 2024 | 50 | 55 |

| IRFC Share Price Target 2025 | 68 | 72 |

| IRFC Share Price Target 2026 | 79 | 84 |

| IRFC Share Price Target 2030 | 140 | 152 |

The table is based on the analysis of IRFC’s chart trend, fundamentals, and growth prospects by StockIPO.

The minimum and maximum prices are only for reference purposes and may vary depending on the market conditions and other factors. Please do your research before investing in any stocks.

IRFC Growth Prospects

The future seems promising for IRFC as it is positioned to gain from the Indian government’s growing investment in the railway industry. To upgrade and broaden India’s rail system, the government has launched several initiatives, including:

- The National Rail Plan (NRP) aims to create a future-ready railway system by 2030 with a capacity to handle up to twice the current traffic.

- To increase freight transportation and relieve congested passenger traffic, the Dedicated Freight Corridor (DFC) project calls for the building of six high-speed freight routes across the nation.

- The High-Speed Rail (HSR) project plans to build bullet train corridors connecting major cities in India with an estimated investment of Rs 10 lakh crore.

- The Station Redevelopment Program (SRP) intends to redevelop around 400 railway stations into world-class transit hubs with modern amenities and commercial facilities.

All these projects require huge capital expenditure and IRFC is expected to play a key role in financing them. According to its IPO prospectus, IRFC has an agreement with the Ministry of Railways to finance at least 85% of its annual capital expenditure requirement till FY24. This implies that IRFC has a strong visibility of its future revenue stream and growth potential.

Additionally, IRFC has expanded the range of companies it lends to by doing so. These companies include Rail Vikas Nigam Limited (RVNL), Railtel Corporation of India Limited (Railtel), Konkan Railway Corporation Limited (KRCL), and Pipavav Railway Corporation Limited (PRCL). These organizations work on several railway projects, including building new lines, doubling existing ones, electrifying them, improving communications, and connecting ports.

IRFC’s lending to these entities has grown from Rs 3,788 crore in FY17 to Rs 22,307 crore in FY21, representing a CAGR of 55.4%.

IRFC also intends to investigate new development opportunities, including leasing of rolling stock assets to private operators, funding of international railway projects, and involvement in PPP models. These measures will aid the IRFC in increasing its profitability and diversifying its revenue streams.

IRFC Valuation Analysis

To estimate the fair value of IRFC’s share price, we will use two valuation methods: the price-to-earnings (P/E) ratio and the discounted cash flow (DCF) model.

P/E Ratio Method

The P/E ratio is a commonly used valuation metric that compares the market price of a share with its earnings per share. It indicates how much investors are willing to pay for a share based on its earnings potential.

To calculate the P/E ratio of IRFC, we will use the following formula:

P/E ratio = Market price per share / Earnings per share

As of November 23, 2022, the market price of IRFC’s share was Rs 25.65.

The earnings per share of IRFC for FY21 was Rs 4.4.

Therefore, the P/E ratio of IRFC as of November 23, 2022 was:

P/E ratio = 25.65 / 4.4 = 5.83

This means that investors are paying Rs 5.83 for every rupee of IRFC’s earnings.

To estimate the fair value of IRFC’s share price using the P/E ratio method, we need to find out the average P/E ratio of its peer group. We will use the following companies as IRFC’s peers:

- Power Finance Corporation Limited (PFC)

- Rural Electrification Corporation Limited (REC)

- Housing and Urban Development Corporation Limited (HUDCO)

- Indian Renewable Energy Development Agency Limited (IREDA)

These companies are also public sector enterprises that provide financial services to various infrastructure sectors in India.

The table below shows the market price, earnings per share, and P/E ratio of these companies as of November 23, 2022.

| Company | Market Price (in Rs) | EPS (in Rs) | P/E Ratio |

|---|---|---|---|

| PFC | 133.85 | 18.6 | 7.19 |

| REC | 156.15 | 24.1 | 6.48 |

| HUDCO | 49.05 | 7.3 | 6.72 |

| IREDA | 28.75 | 3.1 | 9.27 |

The average P/E ratio of these companies is:

Average P/E ratio = (7.19 + 6.48 + 6.72 + 9.27) / 4 = 7.42

We will use this average P/E ratio as a benchmark to value IRFC’s share price.

To calculate the fair value of IRFC’s share price using the P/E ratio method, we will use the following formula:

Fair value = Average P/E ratio x Earnings per share

Using IRFC’s earnings per share for FY21 as Rs 4.4, we get:

Fair value = 7.42 x 4.4 = Rs 32.65

This means that based on the P/E ratio method, IRFC’s share price should be around Rs 32.65.

DCF Model Method

The DCF model is another valuation method that estimates the present value of a company’s future cash flows. It is based on the principle that the value of a company is equal to the sum of its expected cash flows discounted at an appropriate rate.

To calculate the fair value of IRFC’s share price using the DCF model method, we will use the following steps:

- Estimate IRFC’s free cash flow (FCF) for the next five years (FY22-FY26).

- Estimate IRFC’s terminal value (TV) at the end of FY26.

- Discount IRFC’s FCF and TV to their present value using an appropriate discount rate.

- Sum up the present values of FCF and TV to get IRFC’s enterprise value (EV).

- Subtract IRFC’s net debt from EV to get IRFC’s equity value.

- Divide IRFC’s equity value by its number of shares outstanding to get IRFC’s fair value per share.

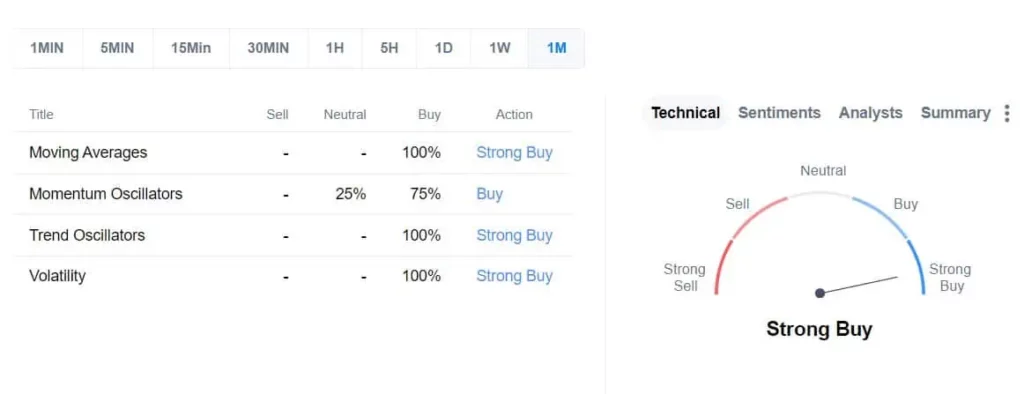

Technical Analysis of IRFC

Technical analysis of IRFC is a way of studying the past and present price movements of IRFC’s share and predicting its future direction. Technical analysis uses various tools, such as:

- Moving averages: They show the average price of a share over a certain period. They help to identify the trend and its strength. For example, IRFC’s share price is above its 50-day and 200-day moving averages, which means it is in a strong uptrend.

- Oscillators: They measure the momentum and strength of a share price movement. They show the overbought or oversold conditions of a share. For example, IRFC’s RSI is 68, which means it is near the overbought level and may face some resistance.

- Chart patterns: They are shapes formed by the price movements on a chart. They help to anticipate the future direction and target of a share price. For example, IRFC’s share price has formed a cup and handle pattern, which is a bullish continuation pattern that indicates a possible breakout to the upside.

These are some of the technical analysis tools for IRFC. You can use them to find trading opportunities, entry and exit points, and risk-reward ratios. However, you should also consider other factors, such as fundamentals, news, and market sentiment, before making any investment decision.

Concerns and Risks

Some of the concerns and risks of IRFC are:

- It relies on the Indian Railways for most of its income. Any change in its business from the Indian Railways, any direct borrowing by the Indian Railways, or any new funding options by the Ministry of Railways could hurt its business.

- It must deal with shifting interest rates, currency values, and credit ratings that may have an impact on its ability to borrow money and generate income.

- Its market share and development potential may be impacted by competition from other financial institutions including banks, NBFCs, and multilateral agencies.

- It follows various rules and regulations, which could increase its operational costs and liabilities.

- It is affected by the Covid-19 pandemic, which could affect the demand for railway services and the financial health of the Indian Railways.

Conclusion

According to the experts’ opinions, the IRFC share price target could reach Rs 80 by 2025. This is based on the strong fundamentals, technical analysis, and government backing of IRFC. IRFC has a promising future as it is the main financier of the Indian Railways and its various projects. IRFC has also shown consistent growth in its revenue, profit, and assets over the years.

However, you should always be careful when investing in the stock market, as there are risks involved. You should do your research and have a long-term outlook to get better returns.

FAQs

What is IRFC, and why should I consider investing in its stock?

IRFC is a public sector enterprise under the Ministry of Railways that provides financial assistance to Indian Railways for acquiring rolling stock assets and meeting other developmental needs. IRFC is the most profitable railway PSU and has a consistent track record of growth and dividend payment. IRFC’s business model is low-risk and high-reward, as it enjoys a sovereign guarantee from the government of India and has a monopoly in leasing railway assets. IRFC’s stock is attractive for long-term investors who seek stable returns and capital appreciation.

What are the potential benefits of IRFC’s stock in 2025?

According to share market experts, IRFC’s stock price target for 2025 could be in the range of Rs 80-90 per share.

Are there any risks associated with investing in IRFC stock?

IRFC’s profitability may be affected by factors such as economic slowdowns like COVID, changes in government policies, and interest rates on its high debt.

Economic downturns like COVID-19, policy changes by the government, and interest rates on its massive debt are some of the major risks that can impact IRFC’s profitability.

Changes in government policies, interest rates on its huge debt, and economic slowdowns like COVID are some factors that may pose risks to IRFC’s profitability.

Is IRFC a good share to buy?

The opinion on IRFC shares, according to Nilesh Jain of Centrum Broking, is favorable. “The upward trend is most likely to last. It still has a potential upside of Rs. 85 to 90,” he added. Jain, however, advised against making new purchases at the present market price because it has increased by more than 50% during the previous month.

What is the target price of IRFC in 2025?

Target Price for IRFC Shares in 2023, 2024, and 2025

According to the expert’s predictions, the IRFC share target price will reach Rs 80 by 2025. Being supported by the government, having solid fundamentals, and supporting technical analysis all point to IRFC’s potential as a long-term investment.

Why is IRFC increasing?

They credit the Ministry’s request for Cabinet approval on a sizable investment program ranging from 2024 to 2031, worth Rs 5.25 lakh crore, for the current uptick in sector-related equities. Research Analyst at GCL Broking Vaibhav Kaushik expressed unwavering faith in IRFC’s continued strength.

I have written this article i.e. IRFC Share Price Target 2023, 2024, 2025, 2026, 2030 on the request of you people only, so if you also want to know about any other share, then you can comment. We will discuss that in the upcoming article. If you have any questions regarding this then you can we will try to reply to you best.

Also Read –

DISCLAIMER – Stock Market investments are subject to market risks, read all scheme-related documents carefully before investing.