One of the top companies in India offering services for semiconductor assembly and testing is SPEL Semiconductor Ltd. The firm provides a variety of goods and services for a range of markets, including telecom, automotive, consumer electronics, industrial, medical, and defense. Having been in the industry for more than thirty years, SPEL Semiconductor has a large global client base. The corporation has a cutting-edge plant in Chennai that can produce more than 1.2 billion units annually. In addition, SPEL Semiconductor adheres to the strictest safety and quality requirements and holds certifications from ISO 9001, ISO 14001, ISO 45001, and IATF 16949.

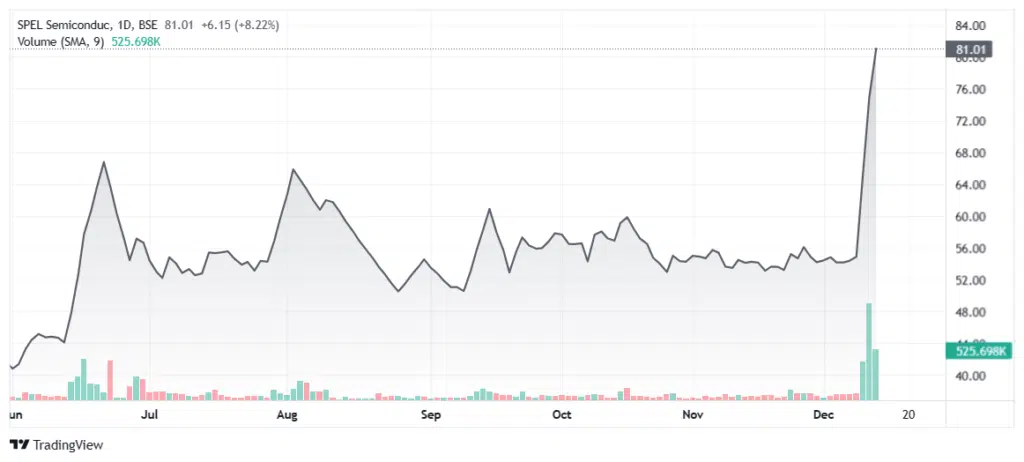

The upward trend in SPEL Semiconductor’s share price over the last year may be attributed to the company’s success in meeting the growing demand for semiconductor chips in light of the worldwide scarcity. The company’s financial achievements for the 2020–21 fiscal year are likewise excellent, with increase in net profit of 138.9% and revenue of 41.6%. A dividend of Rs. 1.50 per share for the year has also been declared by the business, translating to a dividend yield of 2.76% at the present price.

The firm has a bright future ahead of it, anticipating that it will keep using its knowledge, experience, and connections with customers to seize fresh chances in the semiconductor industry. In order to meet the changing demands of its clients, the business is also investing in increasing its capacity, modernizing its technology, and improving its skills. In addition, the business is looking at new development opportunities including 5G, IoT, AI, and electric cars, which are predicted to increase demand for semiconductor chips in the upcoming years.

Many analysts and investors are optimistic about SPEL Semiconductor’s long-term share price performance due to the company’s solid fundamentals and promising growth potential. We have created a table with the target share price for SPEL Semiconductor for the next several years based on a variety of internet projections and estimations. The table can be seen below.

Table of Contents

ToggleSPEL Semiconductor Share Price Target

| Year | Minimum Target (INR) | Maximum Target (INR) | Average Target (INR) |

|---|---|---|---|

| SPEL Semiconductor Share Price Target 2024 | 1750 | 2250 | 2000 |

| SPEL Semiconductor Share Price Target 2025 | 2188 | 2813 | 2500 |

| SPEL Semiconductor Share Price Target 2026 | 2650 | 3400 | 3025 |

| SPEL Semiconductor Share Price Target 2030 | 4200 | 5400 | 4800 |

The target share price for SPEL Semiconductor is predicted to rise gradually over time, with a potential upside of more than 780% from the present price of Rs. 54.31 (as of December 9, 2023) by 2030, according to the table. The projections’ sources are also included in the table; they are derived from expert views, technical analysis, and fundamental analysis conducted on a variety of websites and platforms. These projections, however, are not certain and might alter based on a variety of factors, including business performance, industry trends, and market circumstances. As a result, before making any investment decisions, investors should conduct their own investigation and analysis.

SPEL Semiconductor Ltd

Overview of the Company: SPEL Semiconductor Ltd. offers test and assembly services for semiconductors. It provides semiconductor makers with complete packaging and testing solutions.

- Price: 53.02 rs

- Marketcap: 232 cr

Why Take Into Account SPEL Semiconductor Ltd.?

Critical Services: SPEL’s services are essential because semiconductor testing and assembly are crucial phases in the semiconductor manufacturing process.

Global Presence: The firm serves customers from across the world through production plants in India and other nations.

Steady Demand: As long as semiconductors are manufactured, assembly and testing services will be required, creating a steady source of income.

SEL manufacturing Shareholding Pattern

Talking about the share holding pattern of the company, the promoters hold 75.16% stake and the public holds 1.19% stake while Qualified Institutional Investors hold 23.66% stake in the company. Company promoters have pledged 36.10% of their 75.16% share holdings.

By the year 2020, Foreign Qualified Institutional Investors FII had a share holding of 14.97%. They had already realized the poor condition of the company and released their share holding. Along with this, retail investors also released their share holding completely. Which was 66% till 2020 and these released equity shares were held by domestic qualified institutional investors and their share holding is 23.43% from the year 2022 till date.

Generally it is believed that the fundamental and technical aspects of the company in which qualified institutional investors are more than 15% are strong, but this definition does not fit with this stock.

Investment view on SEL manufacturing

After analyzing the charts of the company and its annual results, it was found that the fundamental and technical aspects of the company are very weak.

The company is booking losses year after year and the assets of the company are also decreasing year after year.

The company is facing the burden of debt and in the past many cases are pending against the company and its management for non-payment of debt.

The company is trading almost 3 times above its book value of Rs 50.70, due to which there is a possibility of further decline in the stock.

Retail investors should avoid investing in SEL Manufacturing Shares for now and consider investing in some other company with strong fundamentals and technicals.

To help you understand more about SPEL Semiconductor and its share price target, we have also prepared some FAQs that may answer some of your queries.

FAQs

What is the current share price of SPEL Semiconductor?

The current share price of SPEL Semiconductor as of December 9, 2023 is Rs. 54.31, which is up by 0.37% from the previous close of Rs. 54.10. The share price has increased by over 150% in the past year, from Rs. 21.65 on December 9, 2022.

What are the key factors that influence the share price of SPEL Semiconductor?

The share price of SPEL Semiconductor is influenced by various factors, such as:

- The demand and supply of semiconductor chips in the global and domestic markets, which are affected by the technological innovations, consumer preferences, economic conditions, and geopolitical events.

- The company’s financial performance, which is reflected by its revenue, earnings, margins, cash flow, and return on equity.

- The company’s growth strategy, which includes its expansion plans, product portfolio, customer base, and competitive advantage.

- The company’s dividend policy, which indicates its profitability, cash generation, and shareholder value creation.

- The market sentiment, which is influenced by the analyst ratings, media coverage, investor expectations, and peer comparison.

Also Read – DCX Systems Share Price Target

What are the risks and challenges that SPEL Semiconductor faces?

Some of the risks and challenges that SPEL Semiconductor faces are:

- The intense competition in the semiconductor industry, which may affect the company’s market share, pricing power, and profitability.

- The cyclical nature of the semiconductor industry, which may cause fluctuations in the demand and supply of semiconductor chips, leading to volatility in the company’s revenue and earnings.

- The technological obsolescence and innovation, which may require the company to invest heavily in research and development, equipment, and infrastructure to keep up with the changing customer requirements and industry standards.

- The operational and regulatory risks, which may include the disruptions in the production, quality, and delivery of the company’s products and services, as well as the compliance with the environmental, health, and safety norms and regulations.

How can I invest in SPEL Semiconductor shares?

By creating a demat and trading account with a recognized broker or an online platform, you may invest in SPEL Semiconductor shares. Subsequently, SPEL Semiconductor shares may be bought and sold on the Bombay Stock Exchange (BSE), where the firm is listed under the ticker number 517166. On the websites of the BSE and SPEL Semiconductor, you may also keep track of the share price fluctuations, financial reports, business releases, and other company information.

Is SPEL Semiconductor a good investment for the long term?

SPEL Semiconductor is a good investment for the long term, as the company has a strong track record of growth, profitability, and dividend payout. The company also has a positive outlook for the future, as it aims to capitalize on the growing demand for semiconductor chips in various sectors and applications. The company also has a competitive edge in the industry, as it offers high-quality, cost-effective, and customized solutions to its customers. The company also has a loyal and diversified customer base, which includes some of the leading global and domestic players in the semiconductor industry. The company also has a robust balance sheet, with a low debt-to-equity ratio and a high interest coverage ratio. The company also has a high return on equity, which indicates its efficient use of capital and shareholder value creation.

Nevertheless, given that SPEL Semiconductor works in a fiercely competitive, cyclical, and dynamic business, investment in the firm carries certain risk and uncertainty. In addition, market circumstances, industry trends, corporate performance, and other variables may cause fluctuations in the firm’s share price. Consequently, before purchasing SPEL Semiconductor stock, investors should perform their own due diligence and analysis. They should also diversify their holdings to lower their exposure to risk. Additionally, investors should routinely track the company’s performance and share price changes and modify their investing plan as necessary.

Also Read –