PFC Share Price Target (2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030) | Power Finance Corporation Limited Fundamentals, Financial Trends and more

Are you looking for PFC Share Price Target? If yes, than you are at the right place.

Numerous articles on the potential price of Power Finance Corporation shares have been published online. However, they are not nearly as precise as you would need to make an informed judgement on whether to invest in it or not.

Therefore, our staff has done a wonderful job of gathering adequate information about the PFC stock to aid in your analysis of the stock. That means, we will analyse Power Finance Corporation in detail in this article before projecting what its share price will be in the future. So pay attention till the very conclusion of this article, and now let’s begin.

Table of Contents

ToggleAbout Power Finance Corporation Limited

PFC (Power Finance Corporation) Limited, is a leading financial institution in India. The company is specialised in the financing and development of power sector projects. The company was incorporated in 1986, it plays a important role in the growth and development of the power sector in India.

The good thing about the company is, PFC operates as a non-banking financial company (NBFC) and the company is regulated by the Reserve Bank of India (RBI). PFC raises funds from various sources, including domestic and international markets, to finance power projects all over the country.

The primary business of PFC is to provide financial assistance and to support power generation, plus transmission, and distribution projects. The company offers a range of financial products and services, including project financing, debt refinancing, working capital loans, and advisory services.

Also Read – Adani Green Share Price Target 2023, 2024, 2025, 2026, 2030

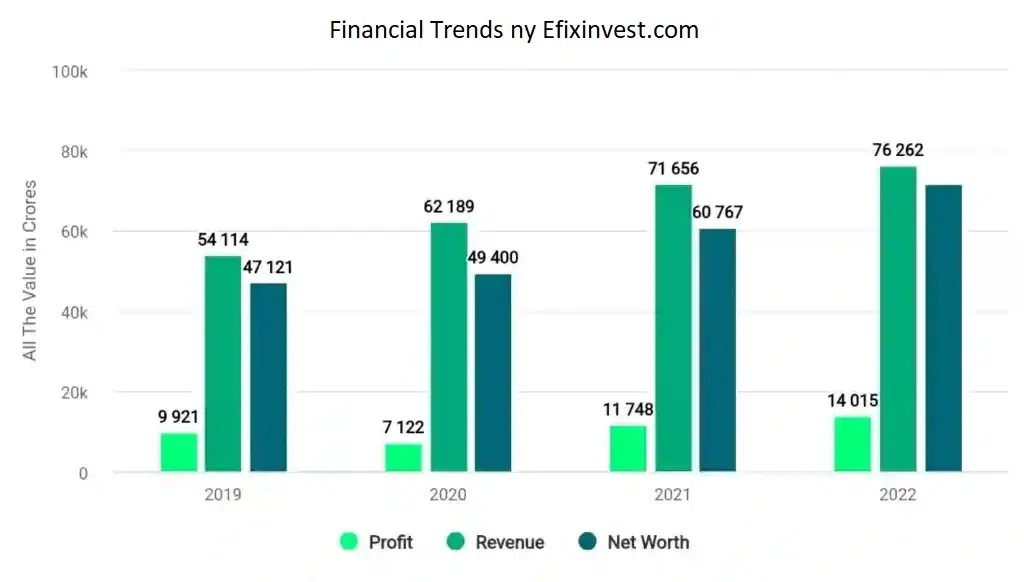

PFC Financial Trends

If we talk about the Revenue and Profit of PFC company then –

Its revenue in 2019 has been ₹ 54,114 Cr and profit is ₹ 9,921 Cr. There was a revenue of ₹ 62,189 Cr in 2020 and a profit of ₹ 7,122 Cr. In the same 2021, there was a profit of ₹ 11,748 Cr with a revenue of ₹ 71,656 Cr. And the year i.e. in 2022 there has been a profit of ₹ 14,015 Cr with a revenue of ₹ 76,262 Cr.

PFC Share Price Target Table

| Year | First Target (₹) | Second Target (₹) |

|---|---|---|

| PFC Share Price Target 2023 | 240 | 245 |

| PFC Share Price Target 2024 | 265 | 275 |

| PFC Share Price Target 2025 | 335 | 350 |

| PFC Share Price Target 2026 | 410 | 440 |

| PFC Share Price Target 2027 | 500 | 650 |

| PFC Share Price Target 2028 | 750 | 824 |

| PFC Share Price Target 2029 | 960 | 1070 |

| PFC Share Price Target 2030 | 1200 | 1400 |

Power Finance Overview

One of India’s top non-banking financial institutions is Power Finance Corporation Limited (PFC). PFC, which was founded in 1986, offers financial support for several power projects including thermal, hydroelectric, and renewable energy sources. Additionally, the firm provides consulting services for power projects and has broadened its line of business to encompass asset management, equipment finance, and advisory services.

Term loans, project-specific loans, equipment financing, short-term loans, and working capital loans are among the primary goods and services provided by PFC. Power projects across the value chain, including those for generation, transmission, and distribution, are funded by the corporation. The 10 to 25 year loan terms offered by PFC make them appealing to businesses in the power industry.

PFC has a broad range of financial products and services that it offers to meet the demands of its customers. While the company’s project-specific loans are made to address the unique requirements of each projects, its term loans are intended to offer long-term funding for power projects. PFC’s equipment finance assists businesses in acquiring the machinery and equipment required for power projects, while its working capital loans and short-term loans give businesses access to money for their immediate needs.

PFC has a great track record of financial success, with consistent revenue growth and profitability over the years, which bodes well for its business prospects in the stock market. Due to the company’s solid fundamentals, alluring dividend yield, and promising future development, its stock has continuously been named among the top choices for investors on the Indian stock market.

Furthermore, PFC is well-positioned to take advantage of the industry’s development potential given that the Indian government is focused on developing the nation’s power sector and encouraging renewable energy. Power projects in the company’s strong pipeline should give it a consistent source of income and growth in the upcoming years.

₹223.30 | |

|---|---|

| Enterprise value | ₹8,196,103,602,176.00 |

| Enterprise revenue | 26.64 |

| Enterprise EBITDA | – |

| Payout ratio | 16.61% |

| P/E ratio | 3.71 |

| Price / Sales | 1.92 |

| Price / Book | 0.70 |

| Book value | ₹318.70 |

| Total cash | ₹178.86B |

| Total cash per share | ₹67.73 |

| Free cashflow | – |

| Operating cashflow | ₹-746.99B |

| Total debt | ₹7.52T |

| Debt / Equity | 671.68 |

| Total revenue | ₹307.62B |

| Revenue per share | ₹116.53 |

| Quarterly revenue growth | -7.70% |

| EBITDA margin | 0.00% |

| EBITDA | – |

| Gross profit | ₹306.60B |

| Gross margin | 99.67% |

| Earnings per share | ₹60.19 |

| 50 day average | ₹185.03 |

| 200 day average | ₹150.51 |

| Last split date | August 26, 2016 |

| Last split factor | 2:1 |

| Ex-Dividend date | June 16, 2023 |

| Dividend rate | ₹13.25 |

| Dividend yield | 6.63% |

| Five Year Avg Dividend Yield | – |

| % Held by insiders | 58.84% |

| % Held by Institutions | 28.19% |

PFC Share Price Target 2023

If we examine its profit from the previous year, it generated a profit of 109%, while in the previous six months, it generated an amazing return of 42%. Due to the firm’s strong performance, large investors also like purchasing this stock. It has been said that this stock might increase by up to 8% this year. Thus, the second price goal for PFC Share is INR 245 and the price target for 2023 is INR 240.

PFC Share Price Target 2024

As we are seeing its growth, according to that, a slight decline can be seen in 2024. But as the company is expanding and the interest of the investors is increasing, Looking at this, it seems that it can definitely give more returns than Bank FDs. Considering these, PFC Share Price Target 2024 will be INR 265 and second target can be 275.

Also Read – Buy or Sell: Vikas Lifecare Share Price Target 2023, 2024, 2025, 2026, 2030

PFC Share Price Target 2025

As we can see, the fundamentals of the company are so good. The P/E ratio of PFC is 3.68 which is good. Same the ROE is 20.39% and EPS is 60.18, which is considered good. And if we look at its book value, then it is 318, which means that the company’s stock can rise more in the future. And what I liked best about this stock is that its dividend yield is 5.99%, which means it gives very good dividend.

So due to its good fundamentals, many investors are showing interest in it. From this we can infer that PFC Share Price Target 2025 will be INR 335 and maximum price can be INR 350.

PFC Share Price Target 2030

If we look at the financial trends of the company, it is also very good. We have seen a very good growth in its profit, revenue and net worth. In 2022, it had the highest profit of 14015 crores and its profit can increase by 15% in 2023, it is being claimed. So, considering the above data, we can conclude that PFC Share Price Target 2030 can be INR 1200 and second target price can be INR 1400.

PFC Share Price Target 2023 to 2030

What the future holds for Power Finance and its share price may be on your mind as an investor. We’ll examine Power Finance’s current situation and make some educated guesses on what its share price may be in ten to thirty years.

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2023 | 175 | 190 |

| 2024 | 200 | 220 |

| 2025 | 230 | 250 |

| 2026 | 260 | 280 |

| 2027 | 290 | 310 |

| 2030 | 380 | 420 |

Conclusion

Friends, we did our best to learn as much as we could about Power Finance Corporation for this post. According to our statistics, it is a bit dangerous to invest in. Please leave a comment if you have any thoughts on whether we should invest in it or not, and if so, why.

Do not invest if you are solely considering the Power Finance Corporation’s share price goal. Because there are several factors that influence the price of stocks. If you have any questions, please post them in the comment section and we’ll do our best to address them by offering a more effective answer.

What will be the share price of PFC in 2025?

After doing lots of analysis about this stocks, share price of PFC in 2025 can be around 335 – 350 rupees.

Is PFC a debt free company?

No PFC is not a debt free company. Currently this company has a debt of ₹ 7,51,158 Cr and its debt to equity ratio is 8.93.

Should I invest in power finance Corporation?

Yes, but you should hold off until the cost falls between $90 and $100. Future growth of the stock is possible due to the increasing demand for power. The start of the electric car trend will boost demand and, as a result, the share price.

Can I earn significant dividend from the investment?

Yes, the corporation has paid its stockholders a sizable dividend. Dividends paid to shareholders typically range from 5% to 10% of their investment.

Who is the chairperson and managing director of the company?

Mr Ravinder Singh Dhillon is the chairperson and managing director of the company.

Also Read –

- Paradeep Phosphates Share Price Target 2023, 2025, 2027, 2030

- Adani Green Share Price Target 2023, 2024, 2025, 2026, 2030

- Buy or Sell: Vikas Lifecare Share Price Target 2023, 2024, 2025, 2026, 2030

DISCLAIMER – Stock Market Investment are subject to market risks, read all scheme related documents carefully before investing