MRPL Share Price Target (2022, 2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030) | Mangalore Refinery and Petrochemicals Ltd Fundamentals, Financial Trends, Future Plans and more

Global energy consumption is rising, which can result in more people using natural gas as a source of heat and power. We can see rise in the sector’s stock as a result. Due to this, we will discuss the natural gas firm MRPL Limited in this article.

Hello, friends This blog’s author is Sachin. We will do a thorough study of MRPL Limited Shares in this post. whereby we’ll make an effort to comprehend business principles, financial patterns, and holdings better. Stay tuned till the end of this blog as we attempt to forecast the MRPL Share Price Target after carefully analysing all of them.

Table of Contents

ToggleAbout MRPL Ltd

In Mangalore, Karnataka, India, there is a public sector oil refining and petrochemicals corporation called Mangalore Refinery and Petrochemicals Limited (MRPL). It is a division of India’s national oil business, Oil and Natural Gas Corporation (ONGC). MRPL was established in 1988 and has a 15 million metric tonne annual capacity for refining.

The firm manufactures a variety of petroleum products, such as aviation fuel, diesel, petrol, and feedstock for petrochemicals. It also includes a division for research and development that is dedicated to creating innovations for the oil and gas sector.

Also Read – What is PE Ratio – Types, Formula, Meaning, Limitations with Examples

MRPL Shareholding

- Promoters hold 88.58%

- Retail and Others hold 9.51%

- Foreign Institutional Investors hold 1.57%

- Domestic Institutional Investors hold 0.25%

- And Mutual Funds hold 0.09% of MRPL share

Domestic institutional investors and mutual funds now own 0.25% and 0.09% of the company, down from 1.18% and 1.35% in the third quarter of 2021, respectively. Any stocks should be concerned about any institutions’ declining holdings.

RPL Fundamentals

| Market Cap | ₹10,700 Cr |

| ROE | 31.10% |

| EPS | 15.16 |

| P/E Ratio | 2.17 |

| Book Value | 56.28 |

| Dividend Yield | 2.49% |

| Debt | ₹16,939 Cr |

| Debt To Equity | 1.72 |

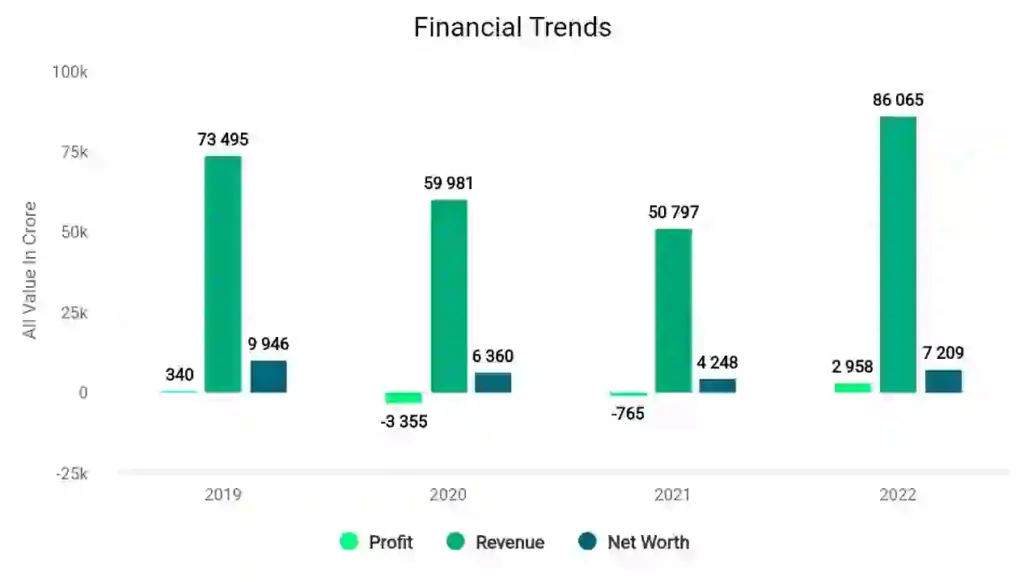

MRPL Financial Trends

If we talk about the Revenue and Profit of MRPL Company then –

It made 340 Cr in profit and 73,465 Cr in sales in 2019. In 2020, there were 59,981 Cr in revenues and -3,355 Cr in profits. With revenue of 50,797 Cr in the same 2021, there was a profit of -765 Cr. And this year, or in 2022, there was a 2,958 Cr profit with an 86,065 Cr revenue.

MRPL Share Price Target 2023 – 2030 table list

| Year | MRPL Share Price Target |

|---|---|

| 2023 | ₹60 – ₹65 |

| 2024 | ₹90 – ₹98 |

| 2025 | ₹126 – ₹135 |

| 2026 | ₹160 – ₹170 |

| 2027 | ₹205 – ₹255 |

| 2028 | ₹300 – ₹360 |

| 2029 | ₹450 – ₹500 |

| 2030 | ₹690 – ₹750 |

MRPL Share Price Target Overview

MRPL Company is a company related to the oil and gas sector, which comes under Petroleum and Natural Gas of India, this company was established in 1998. In 2007, this company was declared a Mini Ratna company by the Government of India. MRPL company’s refinery is located at Katipalla.

If we talk about the price of a share of Mangalore Refinery And Petrochemical Limited company today, then it is ₹ 59.15, today the share of this company has seen an increase of ₹ 0.55 as well as a jump of 0.94%.

Due to the cheap shares of this company, many investors want to know how much returns this company can give in future and how it can grow its business in future. We are going to tell you the answer to all these things in detail below.

MRPL Share Price Target 2023

Gas cylinders have been delivered to every household in India through the Ujjwala scheme launched by Prime Minister Modi, due to which the demand for gas cylinders in India is going to increase a lot in the coming times.

Apart from this, automobile companies are designing their new types of vehicles, due to which the demand for oil is going to increase significantly in the coming times. Looking at all things, the companies associated with the oil and gas sector are constantly focusing on expanding their business. Companies want their services to reach their customers in a better way.

The Chairman of MRPL Company is also continuously focusing on increasing the business of his company in view of such possibility in future, therefore Mangalore Refinery and Petrochemicals Company is starting its new plants despite the losses.

If this strategy of the company works, then in the coming time, along with the business of Mangalore Refinery and Petrochemical Company, there will be a boom in the stock of this company. If we look at the figures of MRPL Share Price Target 2023, then its first share target can be held at ₹ 58 and the second share target at ₹ 70.

MRPL Share Price Target 2024

The company’s management is doing a great job of steadily growing its operations in the oil and gas sector. Investors’ faith in this firm is gradually growing. The company’s returns of -2.17% over the last year and -20.16% over the past six months are not regarded as satisfactory. Investors will make a big return if they have a vested interest in the firm and invest in it.

By these, we can conclude MRPL Share Price Target 2024 of ₹90 and if the company continues its trends then second target can be ₹98.

Also Read – Power Finance Corporation: PFC Share Price Target 2023, 2024, 2025, 2026, 2030

MRPL Share Price Target 2025

MRPL’s financial performance is not yet regarded favourably. The company’s stock will soar in the future if it is successful in immediately strengthening its fundamentals. This company’s earnings was consistently declining, and it even had a loss for two years, but in 2022 it achieved its maximum profit of 2958 crores. With this in mind, the initial objective of 126 for the MRPL Share Price objective 2025 may be seen. And if this stock reaches that goal, a second goal of 135 can be seen.

MRPL Share Price Target 2030

If we look at the returns of Mangalore Refinery And Petrochemical Limited company in the previous years, then it comes out quite well.

Because of this, Profit Booking or Recovery is definitely coming in this company, if you want to invest in this company for a long time, then you have to analyze the data of the previous years of this company properly.

Because there is a lot of debt on the company, so it seems a bit difficult to say that this company will perform well in the future. If we talk about investing in this company for a long time, then MRPL Share Price Target 2030 is the first target of this company. Stock target ₹400 and another stock target ₹600 may appear.

MRPL Share Price Targets 2022-2030

| Years | Target l | Target ll |

| 2022 | ₹64 | ₹72 |

| 2023 | ₹58 | ₹70 |

| 2024 | ₹100 | ₹110 |

| 2025 | ₹140 | ₹160 |

| 2030 | ₹400 | ₹600 |

Looking into the future MRPL Share Price Targets

Looking at the future, it can be said that this company has good prospects in the field of oil and gas. If the company expands its business by reducing its debt, then it can earn a lot of profit.

For this, the management of the company will have to take good decisions continuously, if the company is able to do this, then its profits will start increasing and the company will have money to invest in other businesses.

Risk Factors in MRPL Share

- The company has some debt.

- In the past years, there has been a decrease in the Equity Returns of the company.

- The sales rate of the company has declined in the last 5 years.

- Stocks of the company are currently seen in the overbought zone.

For more details about the share of MRPL Share, watch this video –

Conclusion

The target price that is being told on the basis of technical analysis and its technical time keeps on changing from time to time. That’s why this price target is not accurate, if you invest in it, do it on the basis of your research and never invest due to greed.

I just wrote this post, MRPL Power Share Price Target 2023, 2024, 2025, 2026, and 2030, in response to your requests. If you have any other questions concerning other shares, please leave a remark. That is something we will absolutely talk about in a future article. If you have any questions about this, please ask them and we will do our best to respond.

FAQs

What will be the share price of MRPL in 2025?

According to our predicted Price, if the company improve its fundamentals and financial then we can get to see share price of MRPL in 2025 of INR 126 to INR 135.

Is MRPL a debt free company?

No, the company has a huge debt of ₹18,437 crore and its debt to equity ratio is 2.27.

Also Read –