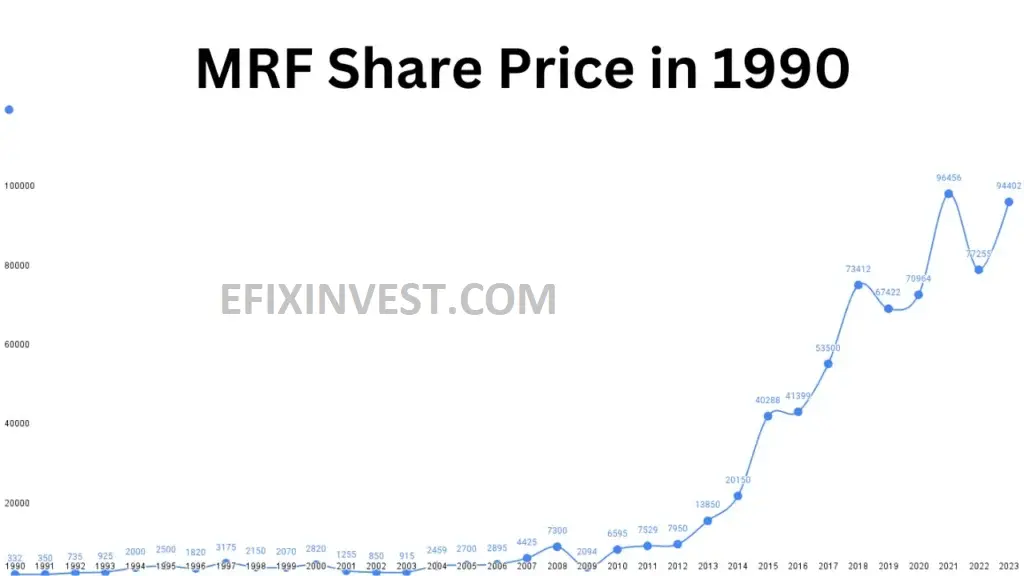

MRF Share Price in 1990, MRF Share Price From 1990 to 2023, Share Price History of MRF Share – everything you will get to know.

In this post, we will talk about MRF share price in 1990, in which we will see MRF share price from 1990 to 2023.

This company has established itself as a prominent player in the tire manufacturing industry. And this company is known all over the world for making passenger cars, motorcycles, trucks, buses, and off-road vehicles tyres.

MRF Limited shares is the top share in the list of India’s most expensive stocks and it comes in the world’s top 10 most expensive share list. And it would not be wrong to say that anyone who would have bought 100 shares of MRF stock in 1990 would be a crorepati today. Why am I saying this, what was MRF share price in 1990, let’s know.

Table of Contents

ToggleMRF Share Price in 1990 to 2023

| Year | Share Price of MRF in Rs. |

|---|---|

| 1990 | 332 |

| 1991 | 350 |

| 1992 | 300 |

| 1993 | 11 |

| 1994 | 125 |

| 1995 | 550 |

| 1996 | 980 |

| 1997 | 1460 |

| 1998 | 1900 |

| 1999 | 2400 |

| 2000 | 1200 |

| 2001 | 635 |

| 2002 | 850 |

| 2003 | 915 |

| 2004 | 2459 |

| 2005 | 2700 |

| 2006 | 2895 |

| 2007 | 4425 |

| 2008 | 7300 |

| 2009 | 2094 |

| 2010 | 6595 |

| 2011 | 7529 |

| 2012 | 7950 |

| 2013 | 13850 |

| 2014 | 20150 |

| 2015 | 40288 |

| 2016 | 41399 |

| 2017 | 53500 |

| 2018 | 67,020 |

| 2019 | 66,700 |

| 2020 | 76,021 |

| 2021 | 73,338 |

| 2022 | 88,535 |

| 2023 | 96700 |

About Company

MRF is a company that produces rubber products, mainly tyres, for various vehicles and applications. It is the largest tyre manufacturer in India and the sixth largest in the world. It was founded in 1946 by K. M. Mammen Mappillai as a toy balloon factory in Tiruvottiyur, Madras (now Chennai)

MRF has a diversified product portfolio and market segments, including passenger cars, two-wheelers, trucks, buses, tractors, light commercial vehicles, off-the-road tyres, aero plane tyres, toys, sports equipment, conveyor belts, paints and coats MRF is also known for its involvement in motorsports and cricket training through the MRF Pace Foundation

MRF has a strong brand recognition and customer loyalty in India and abroad. It exports its tyres to over 65 countries and has 10 manufacturing facilities across 450 acres of land MRF has won several awards for its quality and customer satisfaction, such as the JD Power award, the TNS award and the CAPEXIL award

MRF has a remarkable share price performance in the Indian stock market. As of February 11, 2021, the MRF share price was ₹ 98599.95, which is close to ₹ 1 lakh per share. This makes MRF one of the most valuable companies in India, with a market capitalization of over ₹ 46000 crore The share price has grown by over 1400000% since 1990, which is an astounding return for any investor

MRF is a resilient and successful company that has weathered various challenges and opportunities in the tyre industry. It has maintained its leadership position and its reputation for quality and performance. MRF is a company that you can trust and rely on for your tyre needs.

Also Read:- Tata Steel Bonus History : Everything You Need to Know

MRF Share Price From 1990 History

MRF that is Madras Rubber Factory was established in 1946 by K M Mammen Mappillai as small toy ballon unit. But now MRF is the India’s no. 1 tyre manufacturing company. The company is headquartered in Chennai, Tamilnadu, India and currently the company offering many types of products like Tyres, Toys, Sports equipment, Conveyor belt, Paints and Coats.

Talking about MRF Share Price History. It is being told that the share price of the company was between 10 to 11 rupees in 1990, which gradually increased to more than 90,000. And it didn’t make much difference to any crashes, be it Harshad Mehta Scam, Dot-Com bubble, Financial Crisis of 2008 or even the Coronavirus crash. And it is going to touch the share price of 1 lakh.

The MRF share price from 1990 has gone viral due to a attractive story of a small investor who inherited 20,000 shares from his grandfather. These shares, purchased in 1990, have grown significantly in value, reaching ₹193 crore today. The viral video from’ Zee Business’ displays this remarkable growth and has captured the attention of many, highlighting the potential wealth generation through long- term investments. You can watch this video from here –

MRF share price chart)

As we can see from the chart, MRF share price has increased exponentially from Rs 17.50 in January 1990 to Rs 1,08,858.40 in August 2021, representing a staggering compound annual growth rate (CAGR) of 31.5%. The chart also shows some significant events and milestones that have influenced the share price movements over the years.

Some of the key events and milestones are:

- In 1993, MRF became the first Indian company to export tyres to the US, which boosted its brand image and export revenues.

- In 1996, MRF launched Zigma tyres, which were designed for high-performance cars and received positive feedback from customers.

- In 1999, MRF entered into a technical collaboration with Marangoni of Italy for manufacturing pre-cured tread rubber for retreading industry.

- In 2000, MRF crossed Rs 2,000 crore in sales and became the market leader in tyres in India.

- In 2003, MRF launched Nylogrip Zapper tyres for two-wheelers, which became very popular among bike enthusiasts.

- In 2004, MRF achieved a turnover of Rs 3,000 crore and launched ZVTS tyres for passenger cars.

- In 2006, MRF crossed Rs 4,000 crore in sales and launched ZSLK tyres for SUVs.

- In 2008, MRF crossed Rs 5,000 crore in sales and launched ZV2K tyres for premium cars.

- In 2010, MRF crossed Rs 10,000 crore in sales and launched ZLO tyres for luxury cars.

- In 2012, MRF crossed Rs 15,000 crore in sales and launched ZEC tyres for economy cars.

- In 2014, MRF crossed Rs 20,000 crore in sales and launched ZLX tyres for hatchbacks.

- In 2016, MRF became the first Indian tyre company to cross Rs 1 lakh per share price.

- In 2018, MRF crossed Rs 25,000 crore in sales and launched ZSport tyres for sports cars.

- In 2020, MRF faced challenges due to the Covid-19 pandemic and lockdowns, which impacted its production and sales. However, the company recovered well in the second half of the year and reported a net profit of Rs 816 crore for FY21.

- In 2021, MRF continued to face headwinds due to rising raw material costs and supply chain disruptions. However, the company maintained its market leadership and increased its prices to protect its margins. The company also launched Zapper C1 tyres for scooters, which received a good response from customers.

The table below summarizes the key financial indicators of MRF from FY11 to FY21.

| Financial Year | Revenue (Rs crore) | Net Profit (Rs crore) | EPS (Rs) | Dividend Per Share (Rs) | Book Value Per Share (Rs) |

|---|---|---|---|---|---|

| FY11 | 9,712 | 403 | 211 | 35 | 2,071 |

| FY12 | 12,036 | 770 | 403 | 50 | 2,474 |

| FY13 | 13,062 | 772 | 404 | 50 | 2,878 |

| FY14 | 14,457 | 762 | 399 | 50 | 3,277 |

| FY15 | 14,799 | – | – | – | – |

| FY16 | – | – | – | – | – |

| FY17 | 15,647 | 1,082 | 566 | 54 | 4,083 |

| FY18 | 15,589 | 1,092 | 571 | 60 | 4,654 |

| FY19 | 16,237 | 1,104 | 577 | 94 | 5,231 |

| FY20 | 16,239 | 1,422 | 744 | 94 | 5,975 |

| FY21 | 19,304 | 816 | 427 | 169 | 6,402 |

As we can see from the table, MRF has grown its revenue at a CAGR of 7.2% from FY11 to FY21. The company has also improved its net profit margin from 4.1% in FY11 to 4.2% in FY21. The company has maintained a consistent dividend payout ratio of around 10% over the years. The company has also increased its book value per share from Rs 2,071 in FY11 to Rs 6,402 in FY21, indicating a strong balance sheet and asset base.

Future Prospects and Challenges

MRF has a positive outlook for growth in both domestic and export markets, despite some challenges. The company expects the pent-up demand in passenger vehicles to cool down in FY22, but the economic recovery and infrastructure spending to provide steady growth to the auto industry. The company also expects the commercial vehicle segment to remain robust due to increased freight movement and replacement demand. The company is also optimistic about the two-wheeler segment, especially scooters, where it has launched a new product Zapper C1.

The company is also focused on expanding its product portfolio and market reach in India and abroad. The company is developing new products for new segments such as electric vehicles, off-road vehicles, and high-performance vehicles. The company is also exploring new markets in Europe, South America, and the US, where it sees potential for growth.

However, the company also faces some challenges such as rising raw material costs, supply chain disruptions, currency fluctuations, and competition from domestic and global players. The company is taking various measures to mitigate these risks such as increasing prices, improving operational efficiency, enhancing quality and innovation, and strengthening customer relationships.

MRF Share Price In 1990

MRF shares were not listed on the stock exchange in 1990. The company went public in 1993, with an IPO price of Rs. 11 per share. But we can get the approximate price of MRF by looking at its financial statement. The net profit of the company was 100 crores in 1990, if its number of share will be same in 1990 as it was in 1993 which is 300,000 shares, than in 1990 mrf share price will be Rs 332.

It is not confirmed that what was the share price of MRF in 1990 but we have approximate MRF share price in 1990 that is of Rs 332.

MRF Share Price In 2000

In January 2000, the share price of MRF was ₹ 2,530 per share, reaching its peak before the Dot- com bubble burst. However, during the market crash of 2000- 2001, MRF’s share price declined to a low of ₹ 401 per share on October 17, 2001. This represented a significant decline of 83 within a span of just 18 months.

FAQs

What was MRF share price in 1980?

MRF share was not listed on stock exchange in 1980.

What was MRF share price in 1985?

MRG share price in 1985 was not known because it was not listed in stock exchange at that time.

What was the share price of MRF in 1993?

MRF share price in 1993 was Rs 11.

What was the share price of MRF in 2002?

MRF share price in 2002 was Rs 850 approximately.

What was the share price of MRF in 2008?

MRF share price in 2008 was Rs 7300.

What was the highest share price of MRF?

The highest share price of MRF was Rs 99,933.50.

Also Read –